With a GDP per capita 51% above the EU average, it's easy to imagine that the Swiss have higher incomes, but also a higher cost of living(184% higher than the European average, according to Euronews). So what impact does this have on online shopping? Switzerland has four official national languages: French, German, Italian, and Romansh. German is the most widely spoken language. According to the Swiss Confederation, approximately two-thirds of the population speak more than one language at least once a week

In Switzerland, online commerce increased by 3.5% in 2024, eaching CHF 0.5 billion. 84% of Swiss people aged 16-74 shop online compared to 80% in France, 76% in Belgium, 80% in Luxembourg, and 70% in Germany. The Swiss have a well-established shopping habit, even higher than the European average of 77%.

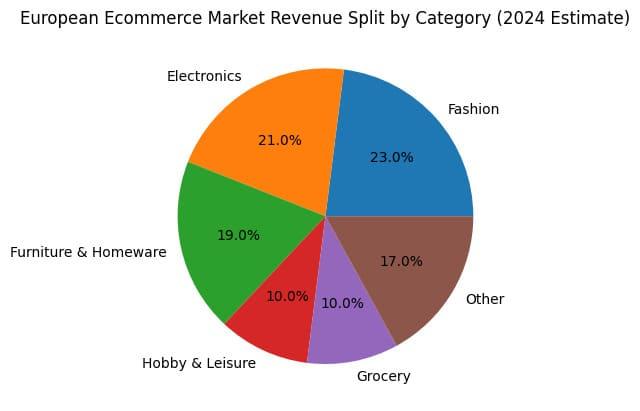

Shopping habits: the favorite category of Swiss customers

In 2024, the Swiss non-food market is comprised of five main sectors: electronics, sports, toys, home furnishings, and fashion/footwear. Electronics holds the largest share at 54%, followed by fashion toys at 35%, and sports and fashion at 30% each.These sectors, primarily electronics and fashion, are largely dominated by giants like Digitec Galaxus and Zalando.

Shopping habits: German customers' favorite category

The 3 favorite categories of German consumers are: fashion with 25.5%, hobbies at 24.3% and electronics at 21.2%.

Source: ECDB

Shopping habits: the favorite category of Belgian customers

Although Belgium does not officially give precise figures, it is estimated that the favorite categories are: fashion at 58%, travel and tickets (between 33% and 40%) and personal care and parapharmacy products.

Source: Dividuals

Shopping habits: the preferred category of French customers

In 2024, in France, 31% of products purchased are high-tech, housing represents 28%, clothing 23%, furniture 24%, fashion products 11% and hygiene and beauty 14.8%.

Source: Fevad 2025

Shopping habits: Italian customers' favorite category

The leisure sector (24%), electronics (22%), and fashion (18%) are the dominant categories in Italy. Furniture and home decor, personal care products, DIY, and food round out the categories favored by Italians.

Source: ECDB

Shopping habits: the preferred category of Luxembourgish customers

Luxembourg remains among the top European countries. 81% of Luxembourgers made online purchases in 2024 (still below the 96% of Irish shoppers for the same year). Luxembourgers' favorite categories are fashion, followed by cultural products and services (books, music, etc.), and then tickets, accommodation, transport, shows, etc.

Source: Retis

Source: Retis

Purchase Frequency and Average Basket Size in Switzerland

No mention of purchase frequency exists in studies in Switzerland, except that the number of orders increased by 25.5% in 2024 compared to the previous year. The Swiss shopping basket is estimated at CHF 190 (or €205), while some sources suggest a lower figure of CHF 131 (or €140).

Purchase Frequency and Average Basket Size in Germany

In Germany, a survey (not an official census) suggests that 39% of residents shop online once a week. The official average basket size is approximately CHF 125 (€134.50).

Purchase Frequency and Average Basket Size in Belgium

No purchase frequency data exists for Belgium either, but the Belgian shopping basket is around €97.

Purchase Frequency and Average Basket Size in France

In France, online shoppers make an average of 54 online purchases per year with an average basket size estimated at €67 for 2025, according to Fevad.

Purchase Frequency and Average Basket Size in Italy

One in three Italians is a regular online shopper. On average, they make 8.2 purchases per month. The average basket size is €75 (or €938 annually), and contains relatively few items (fewer than 4).

Purchase Frequency and Average Basket Size in Luxembourg

Only an approximate purchase frequency exists for Luxembourg. More than 70% of Luxembourgers shop online at least once a month, and 40% shop at least once with the same online store. No precise data is available on the average basket size, but Luxembourgers spend an average of €2,839.20 per year on online purchases.

Price sensitivity: a criterion and the impact of delivery

Switzerland is not part of the EU, and every product ordered from abroad requires the payment of customs duties. Customs clearance adds delays and can lead to frustration if the duties are not paid. Domestic trade, on the other hand, is significantly smoother, and thanks to the country's excellent network (including rail), orders are generally delivered quickly.

Price sensitivity among Swiss consumers

According to a US government study, the Swiss value quality, on-time delivery, and excellent service.Furthermore, Galaxus, Switzerland's leading marketplace, requires its merchants to process a new order, return, or cancellation within one day. This benefits the end customer, and the brand ensures a high-quality customer experience. Galaxus terminates the relationship with a merchant who does not comply. The Swiss character naturally leans towards sustainability.

Price Sensitivity of German Consumers

71% of German consumer decisions are reportedly influenced by discounts, and 60-75% are willing to switch brands if they find a better deal.

Price Sensitivity of Belgian Consumers

Belgium has slightly higher prices than the European average. Because of this slight price increase, Belgians are known for being receptive to coupons, discounts, etc. However, since COVID-19, online retailers have been developing a closer relationship with consumers: a more developed "direct-to-consumer" model in the form of subscription services, social media sales, pop-up stores, etc.

Price Sensitivity of French Consumers

French customers have felt a certain pessimism since the pandemic. The price of electricity, as well as certain ingredients like butter, has skyrocketed. The French are worried about rising prices, and their behavior is changing: 20% of them have switched online retailers and 60% of them have changed grocery stores in the last three months to reduce their expenses.

Price sensitivity of Italian consumers

According to a study by Istituto Piepoli, approximately 9 out of 10 Italian consumers consider price a determining factor before making a purchase.The same research found that about 8 out of 10 wait for promotions before buying. Also according to the same survey, 9 out of 10 appreciate notifications about discounts and sales.

Price sensitivity of Luxembourg consumers

Luxembourg has relatively high prices. Some sources suggest that they are similar to the Swiss: less compromise on quality, but they prefer to pay less. However, there is insufficient data to verify this.

Deliveries: Timeframes, Habits, and Customer Expectations

Delivery times are a crucial element in customer satisfaction. Delivery times represent a kind of agreement between you and your customer. Failing to meet the promised delivery time erodes their trust and can damage your reputation as an e-commerce business.

Home delivery is the primary delivery method, but delivery to collection points is widely used in some countries. 24/7 lockers are increasingly common in Europe.

Deliveries: Timeframes, Habits, and Expectations of Swiss Customers

The Swiss are known for their punctuality. It's worth noting that in Switzerland, there is no law defining delivery times.However, deliveries in Switzerland are extremely fast, with standard delivery times of 1 to 2 days. It's a small country, and there's little tolerance for delays. Even a one-day delay can negatively impact customer satisfaction. The Swiss Post has an excellent reputation.

Deliveries: timeframes, habits and expectations of German customers

In Germany, next-day delivery is increasingly becoming the standard.

Deliveries: Delivery Times, Habits, and Expectations of Belgian Customers

In Belgium, delivery times are around 2 to 3 days, almost like in Switzerland, which is similar to its size.

Deliveries: Delivery Times, Habits, and Expectations of French Customers

In France, standard delivery takes 2 to 4 business days. The French prefer free delivery, and 24-hour express delivery is appreciated for urgent shipments.

Deliveries: Delivery Times, Habits, and Expectations of Italian Customers

Italian consumers are patient. Delivery times vary from 3 to 5 days.However, delivery is free or the fees are low.

Deliveries: Timeframes, Habits, and Expectations of Luxembourg Customers

Luxembourg, even smaller, allows for 24-48 hour delivery from a nearby warehouse.

Preferred Delivery Method

Delivery methods in Europe fall into three categories: home delivery, delivery to a collection point, and 24/7 self-service lockers, a growing trend. Given the environmental and logistical impact of the last mile, consumer choices and habits play (and will continue to play) a significant role in the future of delivery.

Preferred Delivery Method for Swiss Customers

In Switzerland, the postal service dominates deliveries. With a particularly dense network of branches throughout the country, the postal service offers a convenient solution for both sending and receiving packages. It provides various options in case of a missed delivery, either through its app or by choosing a delivery window, extending the collection period, or having the package redirected to another location. Delivery to collection points is still developing, but the postal service offers its own click-and-collect service: My Post 24

Preferred delivery method for Germans

In Germany, pick-up points (or Packstations in German) are common and very popular, with over 40% of Germans using them regularly. However, it's important to note that only packages delivered by DHL Deutsche Post can be picked up.

Preferred delivery method for Belgians

A significant proportion of Belgians use post office collection points or other collection points (e.g., the Kariboo network or UPS Access Points), but not to the same extent as the French.

Preferred delivery method for the French

A majority of French people (57%) say they prefer delivery to a collection point, compared to only 24% of Europeans. Geopost director Carmen Cureu cites a historical reason. "Collection points existed even before e-commerce as such," she told AFP. "They were there for mail-order deliveries and catalog sales. It's something that wasn't available in other European countries," except for Germany. By 2025, only 18% of French people preferred 24/7 lockers.

Preferred delivery method for Italians

Home or office delivery is the most popular (41%), followed by postal pickup points. 24/7 lockers are on the rise (30%).

Preferred delivery method for Luxembourgers

Luxembourg, like Switzerland, has a network of postal relay points. However, home or workplace delivery remains the preferred option.

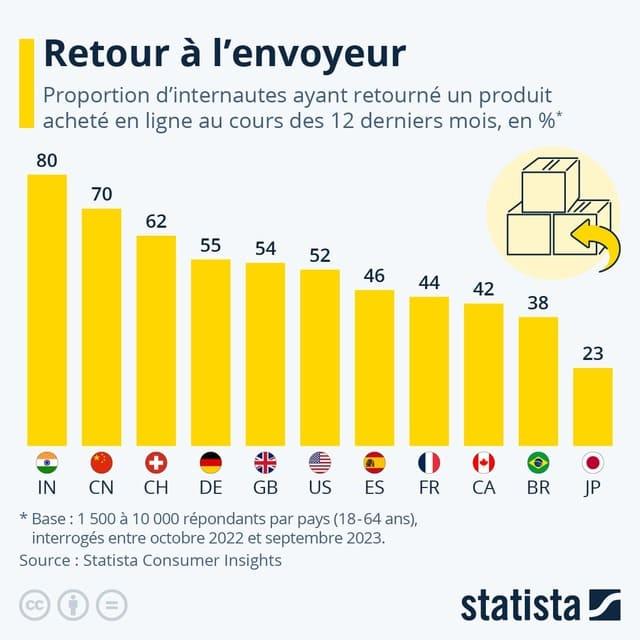

Returns and return policies

Just like last-mile delivery, returns contribute significantly to CO2 emissions and logistical complexity. Furthermore, some brands differentiate themselves by offering free returns, for example. It's worth noting that returns in the fashion sector are significantly higher than in other sectors. The complexity of the return process and the fact that it incurs a fee are the main reasons for order abandonment.

Explore how to reduce your return rates in our blog post"How to Reduce E-commerce Returns."

Source: statista

Returns and Return Policy in Switzerland

According to Statista, approximately 62% of Swiss consumers, just ahead of Germans, have returned a product purchased online in the last 12 months. In the fashion sector, this rate often reaches 60%. Zalando has made its mark by offering free returns, a key element of its success in Switzerland. It offers a free return policy of up to 100 days.

Returns and Return Policy in Germany

German consumers have one of the highest return rates in Europe, between 25% and 30%. In the fashion sector, this rate rises to 50%.

It should be noted that today, it has become standard practice for customers to be offered:

- Free returns

- A prepaid label

- And a quick refund, between 2 and 5 days.

Returns and Return Policy in Belgium

Returns and Return Policy in France

Returns and Return Policy in Italy

Italian consumers have a return rate of 5% for general goods, 15% for electronics, and over 40% for fashion. 73% of them check the return policy before buying a product.

Returns and Return Policy in Luxembourg

There is no publicly available data on the return rate in Luxembourg.

Conclusion: Swiss Consumers with Specific Habits

Swiss consumers are adopting some of the habits of Germany, primarily regarding return rates. However, this rate applies mainly to the fashion sector, where Zalando has imposed its own rules. The Swiss remain cautious when making purchases, and the item must be high-quality, durable, and shipped quickly. Rest assured, if your logistics are based in Switzerland or operate across borders, your Swiss customers will receive their orders promptly.

If you are interested in learning more about Swiss consumers, check out our blog post on Swiss marketplaces.

Swiss vs. French, Belgian, Italian, Luxembourgish and German consumers: key purchasing differences